The dividend rate multiplied by the par value equals the total annual preferred dividend. If it is paid out in installments, such as in quarters, the issuer divides the total preferred dividend by the number of periods to get an approximate installment payment. If a company is financially unable to pay the dividend, the dividends accumulate until it has sufficient cash to make the payment. In such cases, companies must advise their shareholders of the problem. Preferred stock gives the investor a higher claim in liquidation, while preference shares provide the same claims as common stockholders. A dividend on preferred stock is a distribution of cash or other assets to shareholders that is paid out from the company’s earnings and declared by the board of directors.

Create a Free Account and Ask Any Financial Question

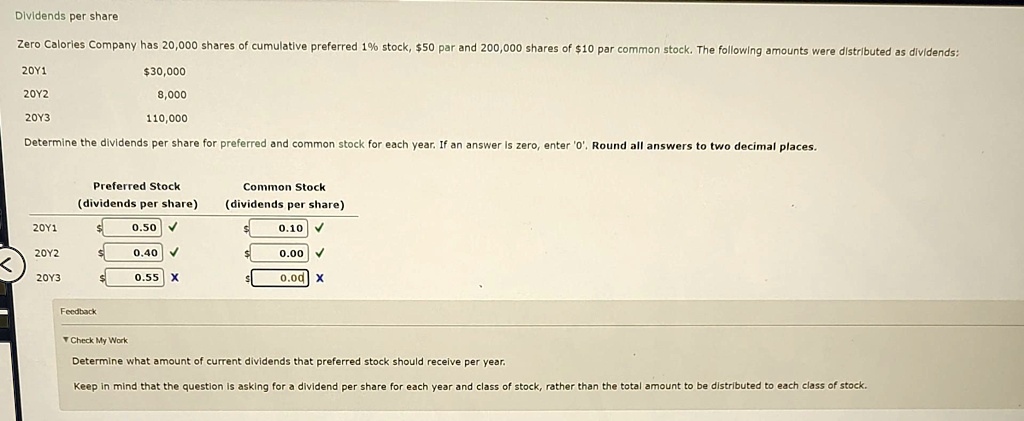

To calculate cumulative dividends per share, you must add the missed dividends to the current dividend from the preferred stock dividends formula. The accumulation and priority of payment over common dividends are key features of cumulative dividends. Companies must fulfill their dividend obligations before distributing profits to shareholders. By prioritizing dividends, companies uphold the rights of shareholders and ensure that their entitlements are respected in difficult circumstances.

What is the impact on diluted eps if it is assumed that preferred shares are converted?

Plus, if the firm gets bankrupt any day, you will be given preference over equity shareholders. If the company becomes bankrupt before equity shareholders are paid a buck, you will get the amounts due to you. Several situations can be considered regarding the issuance of dividends on preferred stock. Since these dividends in arrears have not been declared payable by the directors, they do not constitute a liability. However, they do constitute a significant limitation on the potential cash flows to investors.

- Also, if the dividend has a chance of growing, then the value of the shares will be higher than the result of the calculation given above.

- If the preferred stock is retired at the call price, future preferred dividends may be included in the repurchase.

- The terms “cumulative” and “noncumulative” describe different rules corporations use to pay dividends on preferred stock.

- Preferred stocks have a set dividend rate that’s based on the “par value” of the stock — usually $25, but other amounts do exist.

- If a similar situation occurs with any preferred stocks you own, here’s how to calculate the cumulative dividends owed to you.

What is the approximate value of your cash savings and other investments?

Due to this lower cost of capital, most companies’ preferred stock offerings are issued with the cumulative feature. Generally, only blue-chip companies with strong dividend histories can issue non-cumulative preferred stock without increasing the cost of capital. Cumulative preferred stock is a type of preferred stock; others include non-cumulative preferred stock, participating preferred stock, and convertible preferred stock. Once the company resumes paying dividends, it must pay $1.125 per share to preferred shareholders before making any dividend payments to common shareholders.

Individual and institutional investors can both benefit from the steady income that they can be paid. However, institutions may receive a highly attractive tax advantage in the dividends received deduction on that income that individuals do not. Issuing stock is a complex procedure that requires the help of an experienced attorney. Once you know how to calculate the preferred dividend per share, you need to multiply the number of shares with the preferred dividend per share.

What is a Cumulative Dividend?

The motivation for the redemption is generally the same as for bonds—a company calls in securities that pay higher rates than what the market is currently offering. Also, as is the case with bonds, the redemption price may be at a premium to par to enhance the preferred’s initial marketability. job cost sheet definition The company is not allowed to pay common shareholder any dividends until it pays preferred shareholders all outstanding and current dividends. The boards of directors of public companies determine whether to pay a dividend to holders of its common stock and how much to pay out.

You can find this information in the prospectus for the preferred stock. For example, assume the participating preferred stock pays a dividend of 3 percent. No, to determine diluted eps for convertible preferred stock dividends paid on them will not be deducted from net income. Dividends paid on the convertible preferred would reduce the amount to be distributed as a dividend and therefore reduce the number of shares that need to be included in the denominator. The seniority of preferreds applies to both the distribution of corporate earnings (as dividends) and the liquidation of proceeds in case of bankruptcy.

Preferred dividends are paid before common dividends but after interest on the debt. The dividends that should be paid to the preferred shareholders get accumulated if the company doesn’t earn sufficient profit to pay them. Whenever the company earns a profit, it must clear the past accumulated dividends first, and then common shareholders can be paid. As the cumulative feature reduces the dividend risk to investors, cumulative preferred stock can usually be offered with a lower payment rate than required for a noncumulative preferred stock.

If due for any reason, the company cannot pay the dividend within the pre-decided date, then the dividend gets accumulated and is paid in the future. For example, a company issues cumulative preferred stock with a par value of $10,000 and an annual payment rate of 6%. The economy slows down; the company can only afford to pay half the dividend and owes the cumulative preferred shareholder $300 per share. The next year, the economy is even worse and the company can pay no dividend at all; it then owes the shareholder $900 per share.

These standard preferred shares are sometimes referred to as non-cumulative preferred stock. This cumulative effect makes cumulative dividends unique from regular dividends on common shares. The compounding aspect causes unpaid cumulative dividends to grow perpetually over time until they are paid off. This is before other classes of preferred stock shareholders and common shareholders can receive dividend payments. Cumulative preferred stock is also called cumulative preferred shares. But if a company misses dividend payments on preferred stock, investors lose out on that income (unless they own cumulative preferred stock).

Annual dividends are calculated as a percentage of the par value, which is the price of the preferred stock at the time it was issued. Because the par value is a fixed number and the percentage is also a fixed number, the annual dividend payments remain the same from year to year. The annual amount is then divided into periodic payments, which are typically made two to four times per year.