Accrued interest journal entries are crucial in recording financial transactions accurately. In ACCA, financial reporting includes the proper classification of income, such as interest. Understanding the interest received journal entry is essential in preparing financial statements per IFRS standards. This forms part of Financial Reporting (FR) and Strategic Business Reporting (SBR) papers, helping candidates learn accurate recognition and disclosure of income. In accounting, the entry is short, but it plays a big role in showing financial health. The interest received adds to the profit of the company and is often shown under “Other Income” in the profit and loss account.

For lenders, accrued interest represents the revenue that has been earned but not yet received. Just like for borrowers, it’simportant to recognize the interest earned in the correct accounting period. Accrued interest journal entries help maintain precise financial statements by recognizing expenses as they occur, even if payment is due later. Regularly reviewing accrued interest entries is crucial for financial accuracy. It helps promptly identify discrepancies or errors, ensuring that financial statements reflect the correct interest amounts owed or earned. By conducting periodic reviews, companies uphold transparency in their financial transactions.

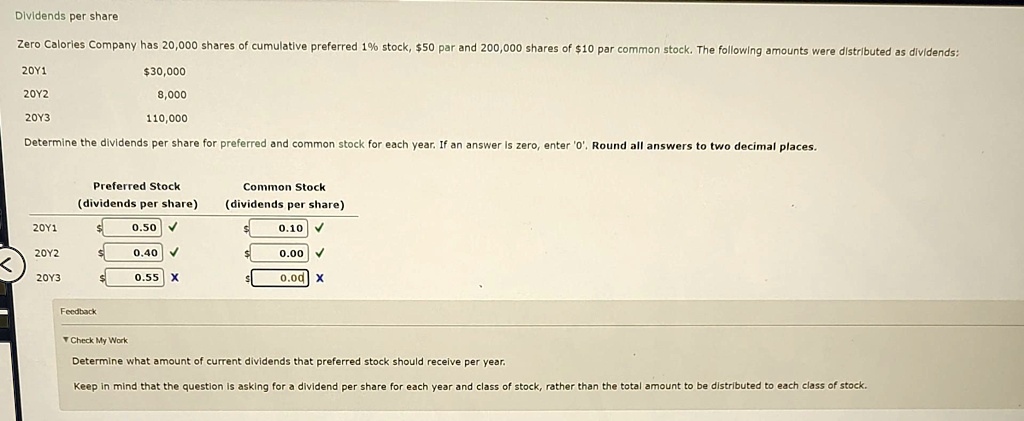

Example 1: Interest from Savings Account

- It is simpler and more intuitive, often used by small businesses and sole proprietors.

- Now let’s look at how to calculate accrued interest and record the journal entries.

- Loans and lines of credit accrue interest, which is a percentage on the principal amount of the loan or line of credit.

- It also allows for the recognition of deferred revenue as a liability, which is gradually recognized as earned income over the contract period.

- The company assumes the risk until its issue, not the investor, so that portion of the risk premium is priced into the instrument.

After calculation, the company record accrued interest receivable and credit interest income. If a loan is truly interest-free, there’s no interest expense or revenue to record, so no accrued interest entries are necessary. However, some jurisdictions may require imputed interest for tax or reporting purposes.

Small businesses may opt for cash basis accounting for simplicity unless regulatory or operational needs dictate otherwise. However, growing companies often switch to accrual accounting to improve their financial insight and reporting. Accrual basis accounting, as discussed, records financial events when they occur, regardless of cash flow.

Accrual Accounting Explained: Summary, Examples, Journal Entries, Applications, & More

Accrued interest can also be recorded at the time a loan or debt is initially issued. This initial entry records the interest owed from the issue date to the end of the current accounting period. However, organizations can record accrued interest more frequently, such as daily or weekly, depending on their specific accounting needs. More frequent entries provide greater precision in allocating interest expenses or revenues to narrower time periods.

- For example, if a loan was taken out on March 19 and the accounting period ends on March 31, the initial accrued interest entry would cover March 19 to March 31.

- The accounts payable on the liabilities side of the balance sheet is added with interest payable as it the expense which is yet to be paid by the Company.

- This ensures that the seller receives fair compensation for the time they held the bond.

- Accrued Interest Receivable is classified as an asset because it represents the money you are owed but have not yet received.

- Read on to learn how to calculate the accrued interest during a period.

- Accruals refer to revenues earned or expenses incurred which have not yet been recorded through a cash transaction.

The interest $ 10,000 covers from 15 June-15 July, however, the portion from June is already recorded as an expense. So company need to record interest expense only $ 5,000, the remaining $ 5,000 is to settle the Accrued interest payable. Accrued interest payable is the current liability that will be settled in the next payment. To illustrate how these principles impact accrued interest, consider a business that takes out a loan to purchase a company vehicle.

Accrual-basis accounting requires companies to record expenses when incurred, not necessarily when cash is exchanged. The payment of loan will be made based on the loan repayment schedule which is started after the borrower receives a loan from the creditor. The loan repayment schedule can be different from the accounting fiscal year. Both borrower and creditor need to prepare annual financial statements, so they need to take into account both revenue and expense.

Any investors who purchase the bonds at par are required to pay the issuer accrued interest for the time lapsed. The company assumes the risk until its issue, not the investor, so that portion of the risk premium is priced into the instrument. When the next coupon payment is made, you will receive the full interest amount, including the portion accrued before you made your purchase. This affects your overall return on the bond investment, as it influences both the amount you pay upfront and the income you will earn. When you buy or sell a bond between coupon payment dates, you will pay or receive the accrued interest for the period since the last payment. This is added to the bond price, giving you the “dirty price.” The price you see quoted initially, the “clean price,” doesn’t include this accrued interest.

Accrued Expenses Guide: Accounting, Examples, Journal Entries, and More Explained

This journal entry will eliminate the $50,000 note payable that we have recorded on July 1, 2021, as well as the $2,500 interest payable that we have recognized on December 31, 2021. Likewise, this journal entry will decrease both total assets and total liabilities on the balance sheet by $52,500 as of January 1, 2022. We can make the accrued interest expense journal entry by debiting the interest expense account and crediting the interest payable account at the period-end adjusting entry. The use of accrued interest is based on the accrual method of accounting, which counts economic activity when it occurs, regardless of the receipt of payment. This method follows the matching principle of accounting, which states that revenues and expenses are recorded when they happen, instead of when payment is received or made.

Issued Bonds

Interest expense is the expense that borrowers need to record over the period of the loan term. It needs to divide equally to each month (if not day) within the loan period. However, the borrower makes payment based on the loan schedule which can be different from the accounting fiscal year.

It is not just about writing entries but also about knowing which accounts to affect, when to record them, and how they impact the books. This part explains the correct method and process to record the interest received journal entry. This provides a more accurate representation of project profitability and financial performance over time.

Accrued Interest Journal Entry Example

To record interest revenue, you need to debit Accrued Interest Receivable and credit Interest Income. So the accrued accrued interest journal entry interest after 25 days on a $10,000 loan at 6% is $41.10. Accrued interest accumulates with the passage of time, and it is immaterial to a company’s operational productivity during a given period. Let’s say you give a loan of ₹50,000 to someone and get ₹3,000 as interest after 3 months. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. Thus, the above example gives us a better idea about the accrued interest in accounting equation.

Formula Application

This is the amount that would need to be recorded in your accounting books. Now let’s look at how to calculate accrued interest and record the journal entries. Thus the above details tell us how to record accrued interest journal entry.